FUSE Networking thanks the following member contributors who made this article possible: Michele Weston (Synovus Bank), Misty Palmer (Tandem Bank), Raymond Grote (RG3 Consultants), Les Flynn (Blue Wolf, LLC), Jordan Girton (Edward Jones), Bob Smith (North American American Health Plans), and Dana Plazyk (Legacy Mortgage Team at Goldwater Bank, N.A.)

Click here for the complete Fuse Networking Resource Member Team

If you are a small business owner (500 employees or less), LLC owner, S-corp owner/shareholder, tribal business concern, veteran organization, self-employed, or an independent contractor and your business has been financially impacted as a result of COVID-19, there are some steps you can take now to help you keep you afloat these rough waters.

On March 27, 2020, President Trump signed into law the CARES (Coronavirus Aid, Relief and Economic Security) Act, a 2-trillion stimulus plan to help all Americans during the crisis.

STIMULUS FOR INDIVIDUALS

- The majority of Americans will soon receive a monetary stimulus (up to $1200 per adult, $500 per dependent child 16 or under) either deposited in your checking account or sent via a check in the mail, based on 2019 taxes (if filed) or, otherwise, 2018 taxes. This portion of the stimulus will be handled by the Treasury Department.

For who qualifies and how it works, click here. - Individuals have the ability to borrow against a qualified retirement plan (401(k) or 403(b)) without penalties for withdrawing funds, as long as hardship caused by the coronavirus is proven and loan is paid back in 3 years. Increased to double the borrowing limit (from $50K to $100K on vested accounts. Only one loan per account. For detailed information, click here.

UNEMPLOYMENT BENEFITS FOR INDIVIDUALS AND INDEPENDENT CONTRACTORS OR SELF-EMPLOYED INDIVIDUALS

- If you find yourself suddenly unemployed, you can file for unemployment benefits through your state’s Department of Labor.

- If you are self-employed or an independent contractor (1099) and your work and source of income has suddenly ceased, under the CARES Act you can also file for unemployment benefits through your state’s Department of Labor.

- Under the new law, state unemployment benefits have been extended by an additional 13 weeks (from 26 to 39), basically through the end of calendar 2020.

- Before the coronavirus crisis, unemployment benefits were limited to either 50% of your income or had a cap of up to $550 per week (differs by state). The CARES Act mandates that $600 be added to regular unemployment insurance on a weekly basis for all. The $600 added stimulus is to last for 4 months, or until you are rehired. Furthermore, you can earn up to an additional $350 per week from doing part-time work.

HEALTH INSURANCE OPTIONS FOR THE UNEMPLOYED

- If you have been laid off or let go from your employment, and no longer have health insurance coverage, there are several options to consider, such as COBRA (Consolidated Omnibus Budget Reconciliation Act), ACA (Affordable Care Act), SEP (Special Election Period) or STM (Short Term Medical). In addition, there might be other programs available for you and your family for the short and long term.

- Before making a commitment on any option, your best option is to consult with a health insurance advisor.

- Click here to download a PDF.

STIMULUS FOR SMALL BUSINESSES AND INDEPENDENT CONTRACTORS

If you are a small business owner (500 employees or less), LLC owner, S-corp owner/shareholder, tribal business concern, veteran organization, self-employed, or an independent contractor, including being part of the “Gig” Economy you may qualify for SBA loans and/or grants.

- You may apply for both PPP (Paycheck Protection Program) loans and EIDL (Economic Injury Disaster Loan), as long as the funds are used for different purposes. In other words, NO DOUBLE DIPPING.

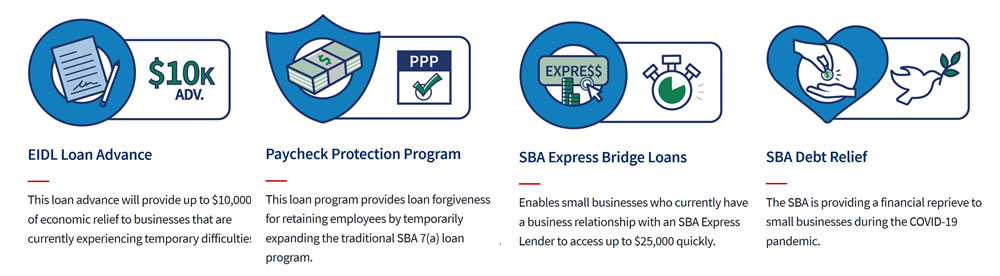

- SBA Funding Options – In addition to traditional SBA funding programs, the CARES Act has established several new temporary programs to address the COVID-19 outbreak.

EIDL (Economic Injury Disaster Loan) Loan Advance

Small business owners that are affected in way or another by COVID-19 can apply for a loan advance of UP TO $10,000. The advance is to provide economic relief to businesses experiencing temporary loss of revenue. Funds are available following a successful application and will not have to be repaid.

- Detailed information https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/economic-injury-disaster-loan-emergency-advance

- To apply: https://covid19relief.sba.gov/#/

EIDL (Economic Injury Disaster Loan)

Maximum loan amount: $2,000,000

- Loans over $200,000 will require a personal guarantee

- Collateral required for loans over $25,000

- EIDL loan advance does not have to repaid if loan is denied

- For paying fixed debts, payroll, accounts payable and other bills that can’t be paid because of the impact of the situation

- Rate: 3.75% for profit, 2.75% for non-profit

- Term: Up to 30 years

- To apply: https://covid19relief.sba.gov/#/

PPP (Payroll Protection Program) Loan

The loan amount will be forgiven as long as…

- The loan proceeds are used to cover payroll costs, and most mortgage interest, rent, and utility costs over the 8-week period after the loan is made

- At least 75% of the loan was used for payroll

- Employee and compensation levels are maintained. Forgiveness will be reduced if full-tie headcount declines, or if salaries and wages decrease

- Payroll costs are capped at $100,000 per individual

- When to apply:

> Small businesses and sole proprietorships can apply beginning April 3, 2020

> Independent contractors and the self-employed can apply beginning April 10, 2020

- Amount of loan: the lesser of $10 million OR the average monthly payroll x 2.5 (i.e., average monthly payroll $10,000, maximum loan $25,000)

- Rate: 1%

- Term: 2 years

- Last day to file: June 30, 2020 but funds are limited (First come, first served)

- To apply: Your bank or an existing SBA 7(a) lender or through any federally-insured depository institution, federally insured credit union, and participating Farm Credit Institution.

- Detailed information: https://home.treasury.gov/system/files/136/PPP–Fact-Sheet.pdf

- Application: https://www.sba.gov/sites/default/files/2020-04/PPP%20Borrower%20Application%20Form.pdf

SBA Express Disaster Bridge Loan

- Allows businesses who have a current business relationship with an SBA Express Lender to quickly access $25,000 if an urgent need arises.

- Detailed information: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/sba-express-bridge-loans/

SBA Debt Relief

If you already have one or more SBA loans for your business that you have used for equipment, expansion, or even real estate, including your own building

- The SBA will automatically pay the principal, interest, and fees of current 7(a), 504, and microloans for a period of six months beginning April 1, 2020

- The SBA will also automatically pay the principal, interest, and fees of new 7(a), 504, and microloans issued prior to September 27, 2020.

- Detailed information: https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/sba-debt-relief/

The information above was compiled on April 6, 2020 and is subject to change without notice.

We, your Fuse Networking members, are ready to help you navigate the CARES Act and how it could be of best benefit to you.

Please contact any of our experts with your questions:

COVID-19 FUSE NETWORKING SMALL BUSINESS CONSULTANTS:

Raymond Grote

Les Flynn

COVID-19 FUSE NETWORKING BANKING CONSULTANTS:

Michele Weston

Misty Palmer

COVID-19 FUSE NETWORKING INVESTMENT CONSULTANT:

Jordan Girton

COVID-19 FUSE NETWORKING HEATH INSURANCE CONSULTANT:

Bob Smith

COVID-19 FUSE NETWORKING INSURANCE CONSULTANT:

Dan White

COVID-19 FUSE NETWORKING MORTGAGE PURCHASE AND REFINANCE CONSULTANT:

Art Wood

COVID-19 FUSE NETWORKING RESIDENTIAL REAL ESTATE PURCHASING, SELLING, LEASING AND INVESTMENT CONSULTANTS:

Jessica Crocker

Karen Armstrong

COVID-19 FUSE NETWORKING COMMERCIAL REAL ESTATE PURCHASING, SELLING, LEASING AND INVESTMENT CONSULTANT:

Rick Ferguson

COVID-19 FUSE NETWORKING PROPERTY PROTECTION CONSULTANT:

Richard Morse

COVID-19 FUSE NETWORKING LEGAL CONSULTANTS:

Hal Parkerson (Business Law)

Scott Fields (Probate and Real State Law)

Paige Staley (Probate and Family Law)

Anita Lamar (Personal Injury Law)

COVID-19 FUSE NETWORKING DIGITAL CONSULTANTS:

David Turney

Ken Fehner

Dana Plazyk

COVID-19 FUSE NETWORKING BRANDING CONSULTANT

Scott Zettergren

COVID-19 FUSE NETWORKING MON-PROFIT CONSULTANT:

Jonathan Brilling